Yes, medical insurance often covers a visit to the dermatologist—but here’s the catch: it all comes down to whether the visit is considered medically necessary.

Think of it like your car insurance. It’s there to pay for repairs after a fender bender (a medical problem), but it won’t cover a custom paint job you want just for looks (a cosmetic choice). This one distinction is the absolute key to figuring out your coverage.

What Your Insurance Considers Covered Care

When you’re wondering if insurance will foot the bill for a dermatology appointment, the answer always circles back to the reason you’re there. Insurance plans are built to pay for the diagnosis and treatment of legitimate medical conditions, diseases, and injuries. They simply aren’t designed to cover procedures done purely for aesthetic improvement.

This creates a very clear dividing line in the world of dermatology. A skin cancer screening or having a suspicious mole removed? That’s a clear-cut medical necessity. By the same token, treatments for chronic or severe conditions that genuinely impact your health are almost always covered.

These typically include things like:

- Severe Acne: When the drugstore stuff isn’t cutting it, prescription treatments for cystic or scarring acne usually get the green light.

- Psoriasis and Eczema: Managing these chronic, inflammatory conditions with prescribed medications and therapies is a medical need.

- Skin Infections: Getting treatment for bacterial or fungal infections of the skin, hair, or nails is considered essential care.

- Rosacea: Interventions to manage the persistent redness, bumps, and inflammation from this condition are often covered.

On the other side of the coin, any procedure aimed at enhancing your appearance is almost always excluded. This is where you’ll find anti-aging treatments like Botox for wrinkles, chemical peels to improve skin texture, or laser hair removal. Insurance companies see these as elective cosmetic services, which means you’ll be paying the full cost out-of-pocket.

To help you get a quick read on where a particular service might fall, we’ve put together a simple table.

Medical vs Cosmetic Dermatology at a Glance

This table breaks down some common dermatology services to give you a clearer picture of what insurance is likely to cover and what it probably won’t.

| Service Category | Common Examples | Typically Covered by Insurance? |

|---|---|---|

| Skin Cancer | Mole mapping, biopsy of a suspicious lesion, skin cancer removal (e.g., Mohs surgery) | Yes – Considered medically necessary for diagnosis and treatment. |

| Acne Treatment | Prescription medications (oral or topical) for cystic or severe inflammatory acne | Yes – When over-the-counter treatments have failed. |

| Chronic Conditions | Management of psoriasis, eczema, rosacea, or hidradenitis suppurativa | Yes – Treatment is necessary to manage symptoms and prevent complications. |

| Infections | Treatment for fungal infections (ringworm), bacterial infections (impetigo), or warts | Yes – Eradicating an infection is a clear medical need. |

| Anti-Aging | Botox for wrinkles, dermal fillers for volume loss, preventative “baby Botox” | No – Considered purely cosmetic. |

| Skin Rejuvenation | Chemical peels, microneedling, laser resurfacing for texture or sun spots | No – These are elective procedures for aesthetic improvement. |

| Hair Removal | Laser hair removal for unwanted body hair | No – Almost always classified as a cosmetic choice. |

| Vein Treatment | Sclerotherapy for small, cosmetic spider veins | No – However, treatment for painful, bulging varicose veins may be covered. |

Remember, this is a general guide. The final decision always rests with your specific insurance plan and the medical documentation provided by your dermatologist.

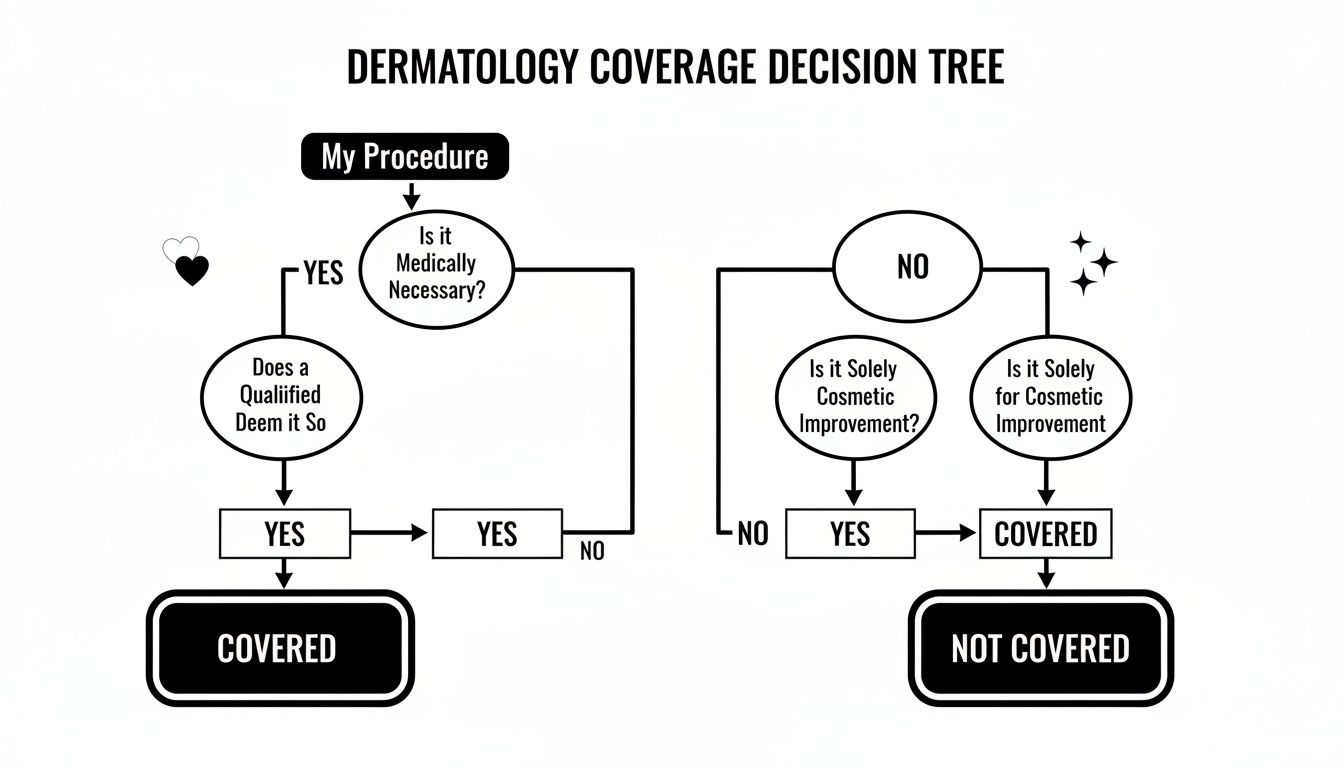

This simple decision tree can also help you visualize whether your procedure is likely to get the nod from your insurance provider.

As you can see, the path to coverage begins and ends with medical necessity. This is precisely why the diagnosis your doctor provides is so incredibly important.

What Does “Medically Necessary” Actually Mean for Your Skin?

Understanding one key phrase is the secret to figuring out if your insurance will pay for a dermatologist visit: medical necessity. Think of it as the gatekeeper for your benefits. Every decision an insurer makes—to pay or deny your claim—boils down to a single question: is this service meant to diagnose, treat, or prevent a medical problem, or is it just to make you look better?

This simple distinction creates two entirely different worlds in dermatology.

Take a mole removal, for instance. It’s a routine procedure, but the why behind it changes everything. If your dermatologist is worried that a mole looks suspicious and needs to be biopsied for cancer, that’s a clear medical necessity. But if you want that same mole removed simply because you don’t like where it is, that’s considered an elective cosmetic choice. Insurance won’t touch it, and the bill is all yours.

When Your Skin Condition Is a Medical Need

Plenty of common skin conditions fall squarely on the “medically necessary” side of the line, especially when they cause pain, itchiness, pose a health risk, or just won’t go away with over-the-counter creams. For these issues, insurance plans are designed to cover your diagnosis and treatment.

Here are a few examples of what’s almost always covered:

- Cystic or Nodular Acne: This isn’t your average teenage breakout. Severe acne causes deep, painful cysts and can lead to permanent scarring. When drugstore products fail, a dermatologist’s intervention with prescription-strength treatments is absolutely a medical need.

- Psoriasis and Eczema: These are chronic, inflammatory diseases, not just a case of dry skin. Getting treatment to control flare-ups, stop the relentless itching, and prevent skin infections is crucial for your health and overall quality of life.

- Rosacea: This condition is more than just a bit of redness. Managing the persistent flushing, bumps, and potential eye complications that come with rosacea is considered a medical necessity.

- Wart Removal: Warts are viral infections. They can be painful, spread to other people, and multiply on your own skin. Getting them removed is a covered treatment to get rid of the underlying infection.

In the eyes of an insurer, a procedure is necessary when it fixes a diagnosed medical issue that affects your physical health. The goal is to restore normal function or stop a condition from getting worse—not to chase a specific aesthetic look.

This is exactly why annual skin cancer screenings and biopsies are always covered. They are fundamental preventative and diagnostic tools for a life-threatening disease.

The Clear Line for Cosmetic Procedures

On the other side, some treatments almost never get the green light from insurance. These are services performed purely to enhance your appearance, not to treat a health problem. Since they are completely elective, insurers classify them as cosmetic, which means you’ll be paying for 100% of the cost out of your own pocket.

Procedures that are almost always self-pay include:

- Laser Hair Removal: While effective, removing unwanted hair isn’t considered a medical treatment.

- Microdermabrasion and Chemical Peels: These are great for improving skin texture and tone, but their purpose is aesthetic rejuvenation, not treating a specific disease.

- Botox for Wrinkles: Using Botox or other neurotoxins to smooth out crow’s feet and forehead lines is the classic example of a cosmetic procedure.

- Sclerotherapy for Spider Veins: Treating those tiny, superficial veins on the legs is done for cosmetic improvement, not for medical reasons.

Getting a handle on this framework is empowering. It helps you walk into your dermatologist’s office with realistic expectations about costs and allows you to have a much clearer conversation with both your doctor and your insurance company about your care.

How Different Insurance Plans Cover Dermatology

Your access to a dermatologist and what you end up paying has everything to do with the type of insurance plan in your wallet. The rules for a private PPO plan can look wildly different from Medicare or Medicaid, creating a confusing landscape for anyone just trying to get a mole checked.

Figuring out these differences is the first critical step to managing your skin health without getting hit with a surprise bill.

The most common plans you’ll encounter are private insurance, usually a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO). With an HMO, you’re typically required to get a referral from your primary care doctor before you can even book an appointment with a specialist like a dermatologist. A PPO, on the other hand, offers more freedom, letting you see any dermatologist you want without a referral—but you’ll pay a lot less if you stick to doctors within their “preferred” network.

Navigating Private Insurance Plans

Whether you have an HMO or a PPO, you need to get familiar with three key terms: deductibles, co-pays, and in-network providers. An in-network dermatologist has a pre-negotiated rate with your insurance company, which translates to lower costs for you. Going out-of-network is almost always a costly mistake, as your insurer will cover a much smaller portion of the bill, if they cover it at all.

Your deductible is the amount you have to pay out-of-pocket each year before your insurance even starts to pitch in. Once you’ve hit that, you’ll still likely have a co-pay, which is just a fixed fee you pay for each visit.

Medicare Coverage for Dermatology

Medicare, the federal health insurance program mostly for people 65 or older, does cover dermatology, but it has its own set of very specific rules. It’s Medicare Part B that typically pays for outpatient medical services, and that includes medically necessary visits to a dermatologist for things like skin cancer screenings, biopsies, or treating psoriasis.

But here’s the catch: Medicare draws a hard line against covering cosmetic procedures. This is a crucial distinction, especially for treatments that walk the line between medical and aesthetic. For example, some eyelid procedures might be dismissed as cosmetic unless they are proven to be medically necessary to improve your vision. You can explore more about how Medicare determines coverage for specific procedures to get a better handle on these rules.

The Realities of Medicaid and Access to Care

Medicaid provides health coverage to millions of Americans, including low-income adults and children. And while it does cover medically necessary dermatology services on paper, patients often run into major roadblocks. The biggest challenge? Simply finding a board-certified dermatologist who accepts Medicaid.

This isn’t just an occasional problem; it’s a well-documented gap in our healthcare system. Study after study has shown that dermatology practices accept public insurance at far lower rates than private plans. One national study published in JAMA Dermatology painted a stark picture: appointment acceptance for a private plan like Blue Cross Blue Shield was nearly 99%, while the rate for Medicaid was dramatically lower.

This disparity creates real-world consequences, forcing patients to wait longer for critical care. The median wait time for a Medicaid patient to see a dermatologist was 22 days, compared to just 13 days for those with private insurance. When you’re dealing with a suspicious or rapidly changing spot on your skin, that extra time can make all the difference.

A Step-by-Step Guide to Confirming Your Coverage

Navigating your health insurance can feel like trying to solve a puzzle with half the pieces missing. But a few proactive steps before your dermatologist appointment can save you from the headache of unexpected bills and claim denials. Think of it as doing a little homework to ensure a smooth, stress-free visit.

Taking control of this process is easier than you might think. By following a clear checklist, you can walk into your appointment knowing exactly what your plan covers, empowering you to make the best decisions for your skin health.

Your Pre-Appointment Coverage Checklist

Before you even book your visit, run through these essential checks. Each one is a crucial piece of the puzzle that helps guarantee your appointment goes as planned—both medically and financially.

- Secure a Referral if Needed: If your plan is an HMO (Health Maintenance Organization), you will almost certainly need a referral from your primary care physician (PCP) before seeing a specialist. Without it, your insurance company can deny the claim, leaving you on the hook for the entire bill.

- Verify Your Dermatologist is In-Network: This is one of the most important—and most overlooked—steps. An “in-network” provider has a contract with your insurance company to offer services at a pre-negotiated, discounted rate. Seeing an out-of-network dermatologist can lead to dramatically higher costs. Always call your insurer or check their online portal to confirm the doctor’s network status.

- Understand Your Benefits and Cost-Sharing: Log into your insurance portal or call the number on your card to ask about your specific dermatology benefits. Get clear on your deductible (what you pay before insurance kicks in), copay (a flat fee per visit), and coinsurance (the percentage of costs you pay after your deductible is met).

Even with insurance, many people are in the dark about their actual benefits. One study found that a shocking 46% of insured people didn’t know if their plan covered skin cancer screenings—a fundamental preventive service. This lack of awareness can unfortunately become a barrier to receiving essential care.

Decoding the Language of Insurance

To have a productive conversation with your insurance company, it helps to speak their language. Two key terms you’ll encounter are ICD-10 codes (for diagnoses) and CPT codes (for procedures).

When you call your insurer, ask the dermatologist’s office for the potential CPT code for your visit or procedure. This simple piece of information allows the insurance representative to give you a much more accurate estimate of your coverage and out-of-pocket costs.

Pro Tip: Don’t just ask, “Do you cover dermatology?” Instead, ask specific questions like, “Is Dr. Smith in my network?” and “What is my financial responsibility for CPT code 99203, which is for a new patient office visit?”

Finally, for more complex or expensive treatments, your insurer may require prior authorization. This means your dermatologist must get approval from the insurance company before performing the procedure to prove it’s medically necessary. Your doctor’s office will handle the submission, but it’s always wise to follow up and ensure it’s approved. This single step can prevent a major financial surprise later on.

Of course, finding the right specialist is the first step, and our guide on how to choose a dermatologist can provide valuable insights.

What to Do When Your Insurance Claim Is Denied

An insurance denial can feel like a brick wall. But in reality, it’s often just the start of a conversation. Getting that denial letter for a dermatologist visit is deeply frustrating, especially when you were confident the service was covered.

The good news? A denial is not a final verdict. You have the right to appeal the decision, and many patients who do so are ultimately successful.

The very first step is to figure out exactly why the claim was denied. Insurers are required to give you a clear reason in their Explanation of Benefits (EOB). Sometimes, it’s a simple clerical error, like a mistyped diagnosis code. Other times, it’s a more fundamental disagreement over whether the procedure was medically necessary.

How to Launch an Effective Appeal

Once you know the “why,” you can start building your case. A methodical, evidence-based approach will always beat an angry phone call. Treat it like a project: your goal is to gather the proof needed to show that the service your dermatologist provided meets your insurer’s own criteria for covered care.

Your game plan should include these key actions:

- Request a Formal Appeal: Your denial letter will have instructions on how to start an internal appeal. Pay very close attention to the deadlines—you typically have a limited window to get your request in.

- Gather Your Documents: Collect every piece of relevant paperwork. This means your EOB, the original claim, and any letters from your insurer. But the most powerful tool in your arsenal is often a letter of medical necessity from your dermatologist.

- Work with Your Doctor: Ask your dermatologist’s office to write a detailed letter explaining why your treatment was critical. This letter should clearly state your diagnosis, describe how the condition impacts your health, and cite any clinical guidelines that back up the treatment choice.

An appeal isn’t about arguing; it’s about providing clear, compelling evidence. A well-written letter from your physician explaining the medical necessity of a procedure is often the single most influential document in getting a denial overturned.

Escalating Your Case

What if your internal appeal is also denied? Don’t give up. You can request an external review, where an independent third party—someone with no skin in the game—reviews your case. This unbiased assessment can be the final step to securing the coverage you deserve.

Remember, persistence is key. Many patients who take the time to formally appeal a denial ultimately succeed in getting their dermatology claim paid, especially when the care was clearly medically necessary.

How to Get Care When Insurance Says No

So, what happens when your insurance plan denies a treatment you desperately need? Or when the wait to see an in-network specialist stretches for months? An insurance denial isn’t the end of the road. Savvy patients are increasingly looking beyond the traditional insurance maze to get the high-quality care they need, right when they need it.

Exploring Direct-Pay and Concierge Dermatology

One of the most powerful alternatives is the rise of direct-pay dermatology. By simply paying for your care out-of-pocket, you sidestep insurance gatekeepers entirely. This model is built on transparency, offering clear pricing, immediate appointment access, and far more personalized time with your physician. It puts you squarely back in control.

This trend is gaining momentum as more elite physicians move away from the headaches of restrictive insurance networks. For instance, the number of dermatologists opting out of Medicare has seen a significant jump, signaling a broader shift toward direct-care models that benefit both doctors and patients. You can learn more about concierge medicine and how it works in our detailed guide.

Key Takeaway: Paying directly is a powerful strategy to access top-tier specialists without the frustrating delays and denials baked into the traditional insurance system. It’s your ticket to immediate, uncompromised care.

Smart Financial Tools for Out-of-Pocket Costs

Paying directly doesn’t mean you have to burn through your savings. A few smart financial tools can make this route surprisingly affordable:

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, an HSA is your best friend. You can contribute pre-tax money and use it to pay for any qualified medical expense, dermatology included.

- Flexible Spending Accounts (FSAs): Many employers offer FSAs, which let you set aside pre-tax dollars specifically for healthcare costs that your insurance won’t cover.

No matter which path you take, Haute MD is your connection to the nation’s most respected board-certified dermatologists. We can help you find the right expert, whether you’re navigating insurance or seeking the freedom of elite direct-pay care.

Frequently Asked Questions About Dermatology Coverage

Even with a grasp of the basics, the fine print of dermatology coverage can get tricky. Let’s tackle a few of the most common questions that come up when you’re trying to figure out what your insurance will actually pay for.

Do I Always Need a Referral to See a Dermatologist?

Not always, but it’s one of the most critical details to check. Your plan type dictates the rules.

If you have an HMO plan, the answer is almost certainly yes. You’ll need to see your primary care physician first to get a referral before the insurance company will even consider covering a specialist visit. With a PPO plan, you generally have the freedom to see any in-network specialist you choose without a referral, giving you a much more direct path to care.

Are All Acne Treatments Covered?

Definitely not. This is a classic example of where insurers draw the line between medical necessity and cosmetic preference.

Prescription treatments for severe conditions like cystic or scarring acne are usually considered medically necessary and are often covered. But if you’re dealing with mild acne, insurers will likely expect you to try over-the-counter options first. Coverage for things like basic topical creams or even some oral medications often only kicks in once you can prove that the standard drugstore remedies have failed.

What About Treatments with Dual Benefits?

This is where things get murky. Some procedures offer both a medical benefit and a cosmetic improvement, creating a gray area that insurers love to scrutinize.

Take laser treatments for rosacea, for instance. The laser can reduce cosmetic redness, but it also manages the underlying inflammation and can prevent the condition from getting worse—a clear medical benefit. For an insurer to cover it, your dermatologist needs to build a rock-solid case with documentation proving the primary reason for the procedure is to treat the medical condition. Without that clear justification, the insurer will almost always label it as cosmetic and deny the claim.

Finding the right specialist is the first and most important step. Haute MD connects you with a network of the nation’s top board-certified dermatologists to ensure you receive expert care, whether you’re using insurance or seeking direct-pay options. Find your doctor at Haute MD.