The cost of private medical care is a moving target. It can range from a few hundred dollars for a quick specialist visit to tens of thousands for a major surgery. Unlike ordering from a menu with set prices, these costs are shaped by the doctor you see, where you live, and what you need, making a single, neat price tag impossible. The first step to getting a handle on it is understanding what actually goes into that final bill.

Understanding the True Cost of Private Healthcare

Stepping into the world of private healthcare can feel like walking into a luxury boutique with no price tags. You know the quality is there—faster appointments, undivided attention, and access to the best specialists—but the final bill is a complete unknown. This lack of price transparency is one of the biggest hurdles for people looking for premium care.

The whole point of private medicine is to deliver a better experience, one that sidesteps the long waits and bureaucratic headaches of the public system. But that premium service comes with a complex pricing structure. Getting a clear picture of the potential private medical care cost isn’t just about budgeting; it’s about making smart, informed choices for your health and your wealth.

The Rising Tide of Global Medical Costs

This isn’t just a local issue—it’s happening everywhere. The price of private medical care is climbing by double-digit rates year after year, putting serious pressure on both individuals and insurance companies across the globe. In fact, medical costs are expected to jump by another 10.4% in 2025, the third straight year of such steep increases.

This relentless upward trend means last year’s price for a procedure is probably not a reliable guide for today. It really highlights how crucial it is to plan ahead financially when you decide to go the private route.

The real power in private healthcare comes from knowing what you’re paying for. It transforms you from a passive patient into an empowered consumer who can advocate for both quality care and fair pricing.

A Starting Point for Common Services

To pull back the curtain on these costs, it helps to have a rough benchmark. While the final number will always depend on your specific situation, getting a general sense of common expenses gives you a solid foundation to start from. The quality of care you get is often tied to these investments, and learning about the benefits of personalized medicine can put these figures into perspective.

To give you an idea of what to expect, here’s a quick look at some ballpark figures for common private medical services. Think of this as your initial guidepost before we dig into the details that can push these numbers up or down.

A Quick Glance at Common Private Medical Service Costs

| Service Category | Typical Cost Range (USD) |

|---|---|

| Specialist Consultation (e.g., Dermatologist, Cardiologist) | $250 – $700+ |

| Diagnostic Imaging (e.g., MRI, CT Scan) | $500 – $4,000+ |

| Minor Outpatient Procedure (e.g., Biopsy, Scope) | $1,500 – $8,000+ |

| Comprehensive Wellness/Executive Physical | $2,000 – $10,000+ |

Remember, these are just estimates. Your actual costs will be shaped by a whole host of factors, which we’ll explore next.

The Hidden Factors Driving Your Final Medical Bill

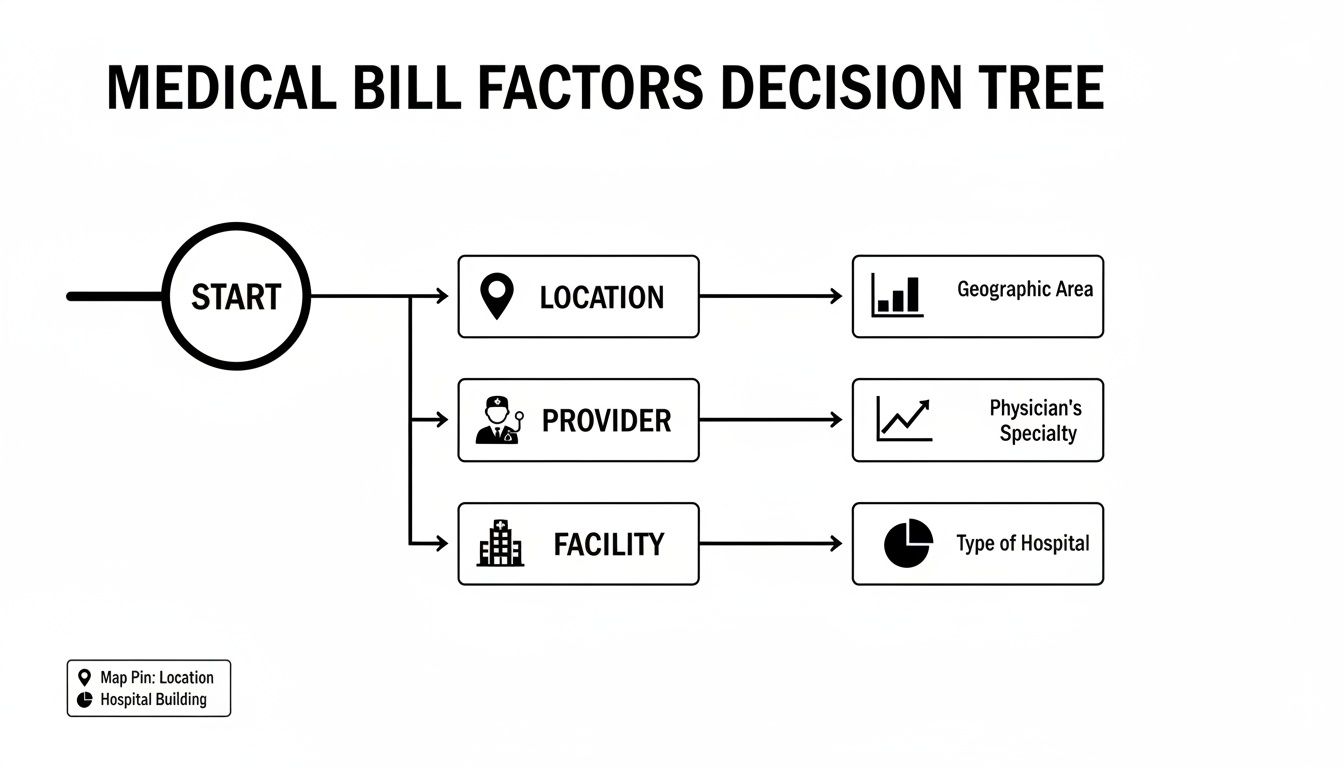

Ever wonder why the exact same medical procedure can cost thousands more in one city than another? The answer isn’t simple. It’s a complex web of variables that quietly shape your final bill long before you ever see it.

Think of it like building a custom home. The final price tag isn’t just about the square footage; it’s about the location, the reputation of the architect, the quality of the materials, and the complexity of the design. Private medical care works on the exact same principle.

Getting a handle on these cost drivers is the first step toward taking control of your healthcare spending. Once you understand how geography, your doctor’s reputation, the facility, and your own medical needs influence the numbers, you can start asking smarter questions and making more informed financial decisions.

Your Location Sets the Baseline Price

More than anything else, your zip code often dictates the starting point for your private medical care cost. Healthcare pricing isn’t national; it’s intensely local.

A top specialist in New York or San Francisco has to cover astronomical operating costs—from office rent and staff salaries to insurance—that a doctor in a smaller city simply doesn’t. Those costs are inevitably passed on to you, the patient.

This isn’t just a domestic issue, either. It’s a global one. When you look at private healthcare costs across major world markets, the differences are stark. A recent deep dive, the SIP Health Cost Index 2025, reviewed private medical expenses across 50 countries. It ranked the United States as number one for the highest costs, followed by Hong Kong and Singapore. The data is clear: location is a massive factor on an international scale. You can dig into the specifics by exploring the global health cost benchmark findings.

The Provider and Facility Premium

Beyond where you live, who you see and where you see them play a huge role in your final bill. Just as a world-renowned architect commands a higher fee, a top-tier surgeon with decades of experience and a pristine reputation will have higher rates than a less established peer. You’re not just paying for a name; you’re investing in expertise, advanced training, and a proven track record of successful outcomes.

The facility itself is just as critical. A procedure done in a large, prestigious hospital system will almost always cost more than the same service at a smaller, independent surgical center. Hospitals have enormous overhead—administrative staff, cutting-edge technology, 24/7 emergency services—and all of it gets baked into their pricing.

Here’s how these choices break down:

- Provider Reputation: A board-certified specialist with a high-demand practice and national recognition can and will charge a premium.

- Facility Type: Large, multi-specialty hospitals carry much higher facility fees than standalone ambulatory surgery centers or private clinics.

- Technology and Amenities: Facilities with the latest diagnostic tools, private recovery suites, and other premium amenities pass those costs along.

Your final bill is a combination of two distinct charges: the provider’s fee (for their expertise) and the facility’s fee (for using their space, staff, and equipment). Always ask for a breakdown of both.

The Complexity of Your Care

Finally, the most personal factor is the complexity of your own medical needs. Two people can go in for the same type of knee surgery, but their final bills might look completely different.

One patient might have a straightforward, textbook procedure. The other might have underlying health conditions, like diabetes or heart disease, that require extra monitoring, specialized equipment, and a longer, more intensive recovery.

This is why a standard price list is only ever a starting point. Your personal health profile, the specific diagnostic tests you need, the length of your procedure, and the potential for complications all add layers of cost. The more complex and resource-intensive your care becomes, the higher the final private medical care cost will be.

Choosing Your Path: Pay-Per-Service vs. Membership Models

Figuring out the financial side of private healthcare isn’t just about the cost of a single visit; it’s about choosing the payment model that fits your life. The structure you pick will define your experience, your level of access, and ultimately, what you spend on medical care.

Think of it like deciding how to travel. You could book flights and hotels a la carte, paying for each part of the trip as you go (pay-per-service). Or, you could join an exclusive travel club for priority access and bundled perks (membership models). Each approach has its place, depending on your health goals and how much you value seamless convenience.

In private healthcare, this choice boils down to three main paths: the classic pay-per-service model, the high-touch concierge medicine subscription, and the increasingly popular direct primary care (DPC) model. Getting a handle on how they differ is the first step to making a smart financial decision.

The Traditional Pay-Per-Service Model

Pay-per-service is exactly what it sounds like and is the model most people are familiar with. You pay for each service you receive—a consultation, a lab test, a specific procedure—right at the time of care. It’s the classic, on-demand way of doing things.

This approach offers total flexibility. You’re not tied to any long-term financial commitment and only pay for what you actually use. If you’re generally healthy and only anticipate needing a few specialist visits here and there, this can be a perfect fit.

The big catch, however, is the lack of predictability. A single, complex health issue can trigger a cascade of separate bills from labs, specialists, and facilities, making it incredibly difficult to budget for your care.

The Rise of Membership Medicine

On the other side of the coin are membership models like concierge and direct primary care. These operate on a retainer or subscription fee, usually paid monthly or annually. In return, you get enhanced access and a bundle of included services.

These models are built to prioritize the doctor-patient relationship over quick, transactional visits. The entire philosophy shifts toward proactive, preventative care with a physician who genuinely knows you, rather than just reacting to isolated problems as they pop up.

Membership-based care is a fundamental shift from volume to value. Instead of being incentivized to see as many patients as possible in a day, physicians can dedicate significant time and attention to a much smaller group of patients, delivering a truly personalized experience.

The real question is whether the upfront private medical care cost of a membership provides enough value to justify the expense for your particular health needs and lifestyle.

As the infographic shows, no matter which model you choose, your final bill is influenced by several key factors.

This decision tree makes it clear: your choices—from the city where you seek care to the specific provider you see—have a direct and significant impact on what you’ll ultimately pay.

Concierge Medicine vs. Direct Primary Care

While they both operate on a membership fee, it’s crucial to understand the key differences between concierge medicine and DPC.

- Concierge Medicine: This is the premium, all-inclusive option. The higher annual fee often covers a wide range of services, 24/7 direct access to your physician via phone or text, and meticulous coordination of any specialist care you might need. Many concierge practices will still bill insurance for services that fall outside the retainer fee. To see how this works in practice, you can dig into this guide on what concierge medicine is and how it works.

- Direct Primary Care (DPC): Think of DPC as a more streamlined and often more affordable alternative. It provides many of the same core benefits—like longer appointments and direct physician access—but for a lower monthly fee. The key distinction is that DPC models generally cut insurance out of the primary care equation entirely, focusing on providing core services directly to the patient for a flat fee.

The choice often comes down to your budget and how much service integration you’re looking for. Concierge is for those who want a white-glove healthcare manager handling every detail. DPC appeals more to people who want to rebuild a strong, direct relationship with their primary care doctor, free from the complexities of insurance billing.

To help you visualize the differences, here’s a side-by-side comparison.

Comparing Private Healthcare Payment Models

| Feature | Pay-Per-Service | Concierge Medicine | Direct Primary Care (DPC) |

|---|---|---|---|

| Cost Structure | Fee for each individual service rendered; no ongoing cost. | High annual/monthly retainer fee, often $2,000 – $10,000+ per year. | Lower monthly fee, typically $75 – $150 per month. |

| Typical Services | Individual appointments, tests, and procedures billed separately. | Comprehensive primary care, 24/7 physician access, wellness plans, care coordination. May still bill insurance for out-of-scope services. | Core primary care services, longer appointments, direct physician communication. Does not involve insurance. |

| Ideal Patient | Generally healthy individuals with infrequent medical needs or those seeking one-off specialist opinions. | Individuals seeking a high-touch, managed healthcare experience with maximum convenience and proactive wellness planning. | Patients who value a strong doctor-patient relationship and predictable primary care costs, without the hassle of insurance. |

Ultimately, whether you opt for the on-demand nature of pay-per-service or the relationship-driven approach of a membership, understanding these structures is key to aligning your healthcare with both your health goals and your financial strategy.

How Health Insurance Works with Private Care

Trying to figure out how your health insurance fits into the world of private medical care can feel like a puzzle. You have one system built for direct, personalized access and another that runs on a complex web of networks, approvals, and reimbursements. The key is understanding how—or if—they fit together to manage your private medical care cost.

Many premium private doctors and clinics operate partially or completely outside of traditional insurance networks. They do this intentionally to sidestep the administrative headaches and reimbursement limits that can get in the way of providing exceptional care. But that doesn’t mean your insurance policy is suddenly worthless.

Instead, the dynamic shifts. You move from a simple in-network transaction to a more hands-on process. You’ll likely pay the provider directly for their services upfront and then submit a claim to your insurance company for reimbursement. How much you get back hinges entirely on your plan’s rules for out-of-network care.

Decoding Your Insurance Policy

To get a handle on the costs, you first have to speak the language of your insurance plan. When you’re dealing with out-of-network private providers, these three terms are absolutely critical.

- Deductible: This is the amount you have to pay out-of-pocket before your insurance plan even starts to chip in. Be aware: your out-of-network deductible is often separate from, and much higher than, your in-network one.

- Copay and Coinsurance: A copay is a flat fee for a service. Coinsurance is the percentage of the bill you’re on the hook for after your deductible is met. For example, your plan might cover 80% of an out-of-network service, leaving you to pay the remaining 20%.

- Out-of-Network Coverage: This is the most crucial piece of the entire equation. Some plans, like PPOs, will partially reimburse you for out-of-network care. Others, like most HMOs, offer no coverage at all except in a true emergency. Knowing exactly what your plan offers here is non-negotiable.

Understanding your out-of-network coverage is like knowing the rules of the game before you start playing. It’s the single most important factor determining whether your insurance will contribute to your private medical bill or leave you to cover the entire cost yourself.

In-Network vs. Out-of-Network: A Tale of Two Scenarios

Let’s walk through a real-world example to see how this plays out. Say you need a specialist consultation that costs $700.

Scenario 1: The Provider is In-Network Your insurance company has a pre-negotiated rate with this doctor, maybe $450. After you pay your $50 copay, your insurer handles the remaining $400. Your total cost is minimal and predictable.

Scenario 2: The Provider is Out-of-Network You pay the full $700 to the doctor’s office upfront. Your plan has a 60% coinsurance for out-of-network care, but only after you’ve met a hefty deductible. Even if you have, they will only reimburse you 60% of what they decide is a “reasonable and customary” fee—which might be just $400, not the $700 you were actually charged.

In this case, you’d get a check back for $240 (60% of $400). Your final out-of-pocket cost balloons to $460 ($700 – $240). The difference is stark.

Strategies for Managing Your Out-of-Pocket Costs

Just because you’re choosing a private provider doesn’t mean you’re stuck with the sticker price. You have more power than you think to make the private medical care cost more manageable.

One of the best tools at your disposal is a Health Savings Account (HSA). If you have a high-deductible health plan, you can contribute pre-tax money to an HSA and use those tax-free funds for qualified medical expenses—including fees from private, out-of-network doctors. It’s a triple tax advantage: your contributions are deductible, the money grows tax-free, and withdrawals are tax-free for medical costs.

Another surprisingly effective tactic is simple negotiation. Many private practices are happy to offer a self-pay discount if you pay in full at the time of service. It saves them the cost and hassle of dealing with insurance, and they can pass a portion of those savings on to you. Never hesitate to ask about cash-pay rates; it can often lead to a significant price reduction.

Real-World Cost Breakdowns for Common Procedures

Price ranges are a good start, but they don’t tell the whole story. The only way to truly grasp the private medical care cost is to follow the money through a complete patient journey, from the first phone call to the final follow-up.

Let’s move past abstract numbers and into real-world situations. By breaking down a few common healthcare paths, you’ll see exactly how a final bill comes together and what you can expect in your own experience.

Scenario 1: A Diagnostic MRI Scan

Meet Sarah, an active professional with a persistent knee injury. To bypass a long wait in the public system, she opts for a private imaging center. It sounds simple, but the final bill is an assembly of different professional services and facility fees.

Here’s how the charges for a single scan can stack up:

- Initial Orthopedic Consultation: Sarah first needs a specialist referral to even get the scan. That visit costs $450.

- Radiologist’s Professional Fee: The expert who actually reads and interprets the MRI images charges their own fee of $300.

- Imaging Center Facility Fee: This is the big one. It covers the use of the $1.5 million MRI machine, the technician’s time, and all the center’s overhead. That comes to $1,600.

Just like that, Sarah’s total out-of-pocket cost for one diagnostic test is $2,350. This shows how even non-surgical care involves multiple, distinct charges that add up quickly.

Scenario 2: An Outpatient Knee Surgery

Let’s continue with Sarah’s story. Her MRI confirms a torn meniscus that requires arthroscopic surgery. She chooses a top-tier orthopedic surgeon and a high-end ambulatory surgery center for the procedure.

Now, the financial complexity really ramps up. Private healthcare spending in the U.S. is on a steep climb, forecasted to hit $5.6 trillion in 2025. Hospitals are expected to claim the biggest piece of that pie at $1.8 trillion, which underscores their huge role in setting the final private medical care cost. You can learn more about the projected growth in US health spending.

Her itemized bill for the surgery could look something like this:

- Surgeon’s Fee: The specialist’s charge for performing the operation is $4,500.

- Anesthesiologist’s Fee: A separate charge from the anesthesiologist for their services during the surgery comes to $1,800.

- Surgery Center Facility Fee: This covers the operating room, nurses, supplies, and recovery area, totaling $8,500.

- Post-Operative Physical Therapy: A crucial package of 12 physical therapy sessions to ensure a full recovery adds another $1,800.

A procedure that takes just a few hours results in a total bill of $16,600. It’s a striking example of how one medical event can spawn five or more separate bills from different professionals and facilities.

The total cost of any procedure is a mosaic of fees from every professional and facility involved in your care. Always request an itemized estimate that includes every anticipated charge to avoid surprises.

Scenario 3: A Comprehensive Concierge Wellness Package

Finally, let’s look at David, a busy executive who enrolls in a concierge medicine practice for proactive, preventative care. He’s not paying for services as he goes; instead, he pays a substantial annual retainer for a complete wellness package designed to optimize his health.

This model is a total shift in thinking—from reacting to problems to managing long-term health. The upfront cost is significant, but it bundles services that would be incredibly expensive if purchased one by one.

A high-end executive physical package might include:

- Annual Retainer Fee: This covers 24/7 physician access and dedicated care coordination for $7,500.

- Advanced Diagnostic Testing: This isn’t your standard physical. It includes extensive blood panels, genetic markers, a full-body MRI for cancer screening, and a cardiac calcium score, valued at $5,000.

- Nutritionist and Health Coach Consultations: The package also includes a series of sessions with wellness experts to build a personalized health roadmap, adding another $1,500 in value.

While the total annual investment is $14,000, it represents a fundamentally different approach. It’s a proactive investment in long-term wellness, designed to prevent the major health events—and their staggering costs—down the line.

Questions You Must Ask Before Your First Appointment

Knowledge is power, especially when you’re navigating the financial side of private healthcare. Walking into a consultation without a clear handle on the costs is like signing a blank check. To sidestep surprise bills and move forward with confidence, you have to become your own best advocate.

This means asking direct, specific questions before you commit to a single test or treatment. A reputable provider won’t just tolerate this conversation; they’ll welcome it and come prepared with transparent answers. Think of the following as your script for taking control of the financial discussion and ensuring total clarity from the start.

Clarifying the Full Scope of Costs

Your first job is to get a complete picture of every potential charge. The initial consultation fee is often just the tip of the iceberg; the real private medical care cost is frequently hidden in the services that follow.

Start with these fundamentals to get a solid baseline:

- Can you provide a detailed, itemized estimate? Don’t settle for a verbal ballpark figure. Ask for a written breakdown of every anticipated cost: the consultation, any potential lab work, imaging scans, and separate facility fees.

- Who will be sending the bills? It’s incredibly common to get separate bills from the doctor, the surgical facility, the anesthesiologist, and the pathology lab. Knowing who all the players are prevents a lot of confusion down the road.

- Is this a “global fee”? For any planned procedure, ask if the price is a bundled “global fee.” This typically includes all related services, from pre-op visits to standard follow-up care, preventing nickel-and-dime charges later.

A vague answer on cost is a major red flag. Top-tier providers who cater to a discerning clientele understand the importance of financial transparency and should be able to provide a clear, detailed estimate without hesitation.

Understanding Insurance and Payment Logistics

Once you have an estimate in hand, the next conversation is about how payment will actually work—especially where insurance fits in. Never assume the office will manage the entire process for you, particularly if they are an out-of-network provider. When you’re looking for the right specialist, you can often find a doctor through curated networks that prioritize this exact level of service and clarity.

Ask these practical questions to get everyone on the same page about payment:

- Will you submit claims to my insurance provider? Some private practices offer this as a courtesy. Others expect you to pay them in full at the time of service, leaving you to handle the entire reimbursement process on your own.

- What are your specific payment policies? Get the details. Is payment due at the time of service, or will you be billed with 30-day terms? What forms of payment do they accept?

- Do you offer any self-pay discounts or payment plans? Many providers have a reduced rate for patients who pay directly without involving insurance companies. Asking about financing options can also make a significant one-time expense much more manageable.

Frequently Asked Questions About Private Medical Costs

When you step into the world of private medical care, a few key financial questions always come up. Getting straight answers is the first step toward making confident decisions for both your health and your budget.

Can I Negotiate My Private Medical Bill?

Yes, absolutely. Thinking like an informed consumer is your biggest advantage here, especially if you’re paying out-of-pocket.

Before you even have a procedure, do some homework. Find out what other top-tier providers in your area are charging for the same service. Armed with that data, you can approach the billing department and confidently ask for a self-pay or cash discount. Providers often grant these because it saves them the time and administrative cost of wrangling with insurance companies.

Is Concierge Medicine Worth the High Price Tag?

Whether the concierge model is “worth it” really boils down to your personal health needs, lifestyle, and priorities. That retainer fee isn’t just for medical care—it’s for unparalleled access and a deep, proactive partnership with your physician.

For anyone managing chronic conditions or who simply places a high value on having 24/7 direct access to their doctor for immediate peace of mind, the investment often makes perfect sense. It buys a level of personalized, preventative attention that’s almost impossible to find in the standard system. On the other hand, if you’re in great health and only see a doctor occasionally, the traditional pay-per-visit route might be a better financial fit.

How Do US Private Medical Costs Compare Globally?

The data doesn’t lie: the United States has, by a significant margin, the highest private medical care cost in the world. While medical inflation is a global trend, the sheer complexity of the U.S. system—with its web of insurers, providers, and a lack of centralized price setting—creates a uniquely expensive landscape.

In many other developed nations, more regulated systems bring a level of price transparency and predictability for patients, even within their private healthcare options.

This isn’t just about the cost of an MRI or a consultation. It highlights how the fundamental structure and market dynamics in the U.S. play a massive role in its outlier status on the global stage.

Ready to connect with top-tier medical specialists who prioritize transparency and exceptional care? The Haute MD network is your curated guide to the nation’s most trusted and rigorously vetted physicians. Find the right expert for your needs and gain access to premium, outcome-driven healthcare. Discover your ideal physician on Haute MD.