When people ask if Medicare covers eyelid surgery, the answer is a firm “it depends.” Coverage hinges entirely on one critical factor: medical necessity. If your drooping eyelids are genuinely obstructing your vision and making daily activities unsafe, Medicare will often step in.

Will Medicare Pay for Eyeld Surgery? The Short Answer

Think of it like this: Medicare will pay to fix a foundation crack that’s compromising your home’s structure (a functional problem), but it won’t pay for a kitchen remodel just because the style is dated (a cosmetic choice). Eyelid surgery, known clinically as blepharoplasty, is viewed through that exact same lens.

If your primary goal is to look younger or more refreshed, the cost is entirely on you. But when the procedure is required to restore your field of vision, it crosses the line from a cosmetic “want” to a medical “need,” opening the door for coverage.

The Critical Distinction: Functional vs. Cosmetic

Medicare draws a very clear, non-negotiable line between functional and cosmetic procedures. This isn’t about your personal preference or even your doctor’s recommendation alone; it’s determined by objective, measurable evidence that proves your vision is significantly impaired.

To get approval, you have to build a strong case that the surgery will correct a real functional deficit. The most common scenarios include:

- Obstructed Vision: This is the big one. Excess skin on the upper eyelids droops so low that it physically blocks your peripheral or upper line of sight.

- Difficulty with Daily Tasks: You must show that this vision loss interferes with essential activities like driving safely, reading a book, or even just walking around your house without tripping.

- Chronic Irritation: In some cases, the extra skin folds cause persistent skin irritation (dermatitis) or turn your eyelashes inward, where they scratch and irritate your cornea.

Medicare’s position is straightforward: if the surgery is performed solely to improve your appearance, it is not covered. The burden of proof is on you and your medical team to demonstrate a genuine medical necessity that impacts your quality of life and safety.

To make this distinction crystal clear, here’s a quick breakdown of how Medicare sees it:

Medicare Eyelid Surgery Coverage At-a-Glance

| Attribute | Medically Necessary (Potentially Covered) | Cosmetic (Not Covered) |

|---|---|---|

| Primary Goal | Restore vision impaired by drooping eyelids. | Improve appearance, achieve a more youthful look. |

| Key Symptom | Verifiable obstruction of the visual field. | “Tired” or “sad” appearance, wrinkles, puffy eyes. |

| Required Proof | Objective visual field testing, clinical photos showing impairment. | Patient’s desire for aesthetic improvement. |

| Doctor’s Role | Document functional impairment and medical justification. | Advise on aesthetic outcomes and possibilities. |

| Medicare’s View | Reconstructive surgery to correct a functional problem. | Elective procedure for aesthetic enhancement. |

Essentially, your entire case must be built on the evidence in the “Medically Necessary” column.

Understanding Potential Costs and Coverage

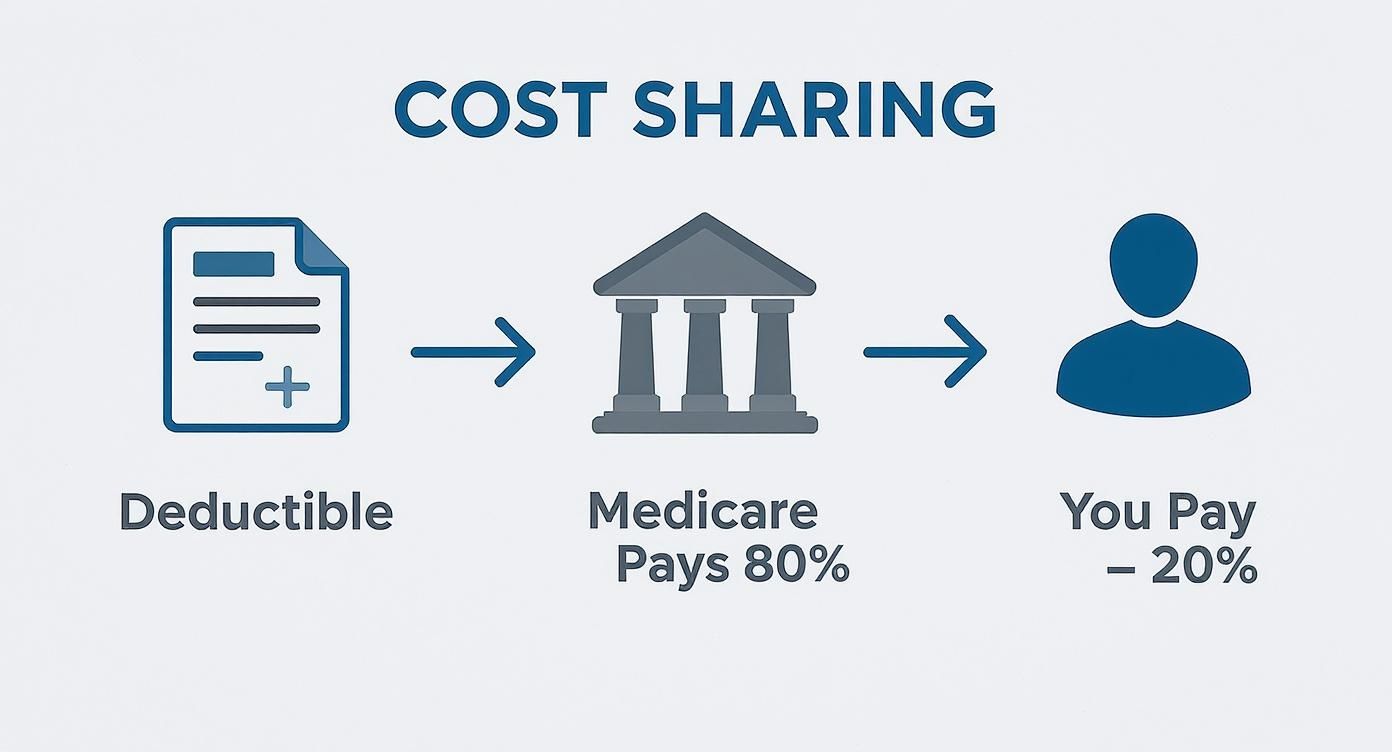

When your surgery is deemed medically necessary, it typically falls under Medicare Part B or a Medicare Advantage (Part C) plan.

For those with original Medicare Part B, you can generally expect it to cover 80% of the Medicare-approved amount after you’ve met your annual deductible. Your final out-of-pocket costs will vary depending on where the surgery happens. On average, you might pay around $297 at an ambulatory surgical center, but that could be closer to $455 in a hospital outpatient setting. You can find more details on Medicare’s cost structures in this helpful guide from Medical News Today.

Of course, getting that approval requires very specific tests and documentation, which we’ll break down next.

Defining Medical Necessity: How Medicare Draws the Line

When it comes to getting Medicare to cover eyelid surgery, one phrase is the absolute gatekeeper: “medically necessary.” This isn’t a vague suggestion; it’s a hard-and-fast standard that requires objective, measurable proof. Your surgeon must provide concrete evidence that your drooping eyelids are causing a genuine, functional problem with your sight.

Think of it like an engineer inspecting a bridge. They don’t just say it “looks weak.” They run stress tests and take precise measurements to prove it can no longer support traffic safely. Medicare operates the same way, demanding specific clinical data before approving a blepharoplasty. This proof comes from a series of diagnostic tests designed to quantify exactly how much your vision is being blocked.

The Crucial Visual Field Test

The absolute cornerstone of any claim for functional eyelid surgery is the visual field test. This exam is the main tool used to map out your peripheral vision. During the test, you’ll look into a machine and click a button every time you see a small flash of light. The results produce a detailed map showing precisely where your vision is clear and where it’s being obstructed.

For Medicare to even consider your case, this test must show a significant loss of your superior (upper) visual field. The drooping eyelid has to physically act like a curtain, creating a blind spot that can be measured on paper.

Meeting Medicare’s Strict Measurement Criteria

This is where the process becomes a numbers game. Medicare has very specific thresholds that your test results must meet or exceed. It’s a pass/fail system with no room for subjective interpretation.

Medicare will only consider blepharoplasty medically necessary if you have a superior visual field of 30 degrees or less. But that’s just the first number. The second part of the equation involves a diagnostic trick called eyelid taping. When the eyelid is taped up, your test results must show at least a 12-degree improvement or a 30% or greater increase in your superior visual field.

This is the critical takeaway: Your claim’s success hinges entirely on meeting these exact percentages and degrees. A visual field loss that feels significant to you but only measures 31 degrees will almost certainly trigger an automatic denial from Medicare.

Beyond the Visual Field: The Taping Test and Other Factors

The visual field test is just the first hurdle. Your doctor must also perform that simple but vital in-office diagnostic: the eyelid taping test.

During this procedure, the doctor uses a small piece of medical tape to gently lift your drooping eyelid into the position it would hold after surgery. They then repeat the visual field test. The goal is to demonstrate a direct cause-and-effect relationship—proving that lifting the excess skin results in that specific, measurable improvement in your vision.

While vision obstruction is the primary qualifier, other functional issues can absolutely strengthen your case for medical necessity, especially when properly documented by your physician.

- Chronic Dermatitis: Excess skin folds can trap moisture, leading to persistent skin irritation, rashes, or infections.

- Mechanical Ptosis: Your eyelids might feel so heavy that you get chronic headaches or brow aches from constantly using your forehead muscles just to see clearly.

- Interference with Eyewear: The sagging skin can physically push down on the frames of your glasses, making them difficult or impossible to wear properly.

- Entropion or Ectropion: Though more common on the lower lid, if your eyelid turns inward (entropion) and causes your lashes to scratch your cornea, corrective surgery is almost always deemed necessary.

Understanding the distinction between cosmetic and plastic surgery is key, as one enhances appearance while the other restores function. Ultimately, getting Medicare on board for your eyelid surgery comes down to your medical team’s ability to provide irrefutable, quantitative proof that your condition is a functional impairment, not simply a cosmetic concern.

Why Meticulous Documentation is Everything

When you ask, “Does Medicare cover eyelid surgery?” the answer lies not in your surgeon’s opinion, but in the stack of cold, hard evidence they submit. Think of it like a legal case: your surgeon is the attorney, and Medicare is the judge. A simple note saying the surgery is “necessary” will get your case thrown out. Victory depends on objective, irrefutable proof.

Your claim file must paint an undeniable picture of functional impairment. It has to tell a clear story, through clinical data and visual evidence, that this procedure is the only viable solution to a significant medical problem.

The Power of Preoperative Photographs

The most powerful evidence in your arsenal is often the preoperative photographs. These aren’t just snapshots; they are clinical-grade images taken under strict protocols, designed to leave no room for doubt.

To build an airtight case, your surgeon’s photo series must clearly demonstrate:

- Frontal View: A straight-on photo with your gaze fixed forward, showing precisely how the upper eyelid skin is resting on or drooping over your eyelashes and pupil.

- Side (Lateral) View: This angle is crucial for illustrating the degree of “hooding” and how much the excess skin sags forward.

- Downward Gaze: A photo of you looking down often exaggerates the obstruction, providing powerful visual proof of just how severely your vision is compromised.

These images become the visual anchor of your entire claim, proving that the eyelid is physically blocking your line of sight.

Clinical Notes: The Narrative That Ties It All Together

If photos are the star witnesses, the clinical notes are the closing argument. Your ophthalmologist’s notes must be thorough, specific, and consistent, creating a documented history of your functional complaints. They need to translate your frustrations into medical facts.

Medicare reviewers are looking for a clear story of cause and effect. Your medical records should explicitly state how your drooping eyelids impact daily life—difficulty reading, trouble seeing street signs, persistent eye strain from struggling to keep your lids open.

The notes also need to show that you’ve already tried less invasive options. Documenting attempts to use specialty eyeglasses or other conservative treatments proves to Medicare that surgery isn’t the first resort, but a necessary final step after other methods have failed.

Ultimately, the surgeon you choose is paramount. Their experience in successfully navigating Medicare’s requirements can be the deciding factor. For those who demand the best outcomes, learning how to choose a plastic surgeon is a critical first step. An elite surgeon’s office won’t just perform the procedure flawlessly; they will be masters at compiling the precise evidence Medicare demands, presenting your case in the most compelling way possible.

Navigating Your Medicare Plan and Potential Costs

Once you’ve established that your surgery is a medical necessity, the next big question is how your specific Medicare plan will handle the bill. This is where things can get a little tricky, because the path to coverage looks very different depending on whether you have Original Medicare or a Medicare Advantage plan.

Each one has its own rules, deductibles, and out-of-pocket expenses. Think of it like booking a flight: one airline might offer a straightforward base fare where you pay extra for bags and seat selection (Original Medicare), while another offers an all-in-one package with specific restrictions but potentially lower upfront costs (Medicare Advantage). Both get you to your destination, but the cost breakdown is completely different.

Coverage Under Original Medicare Part B

If you’re on Original Medicare, your medically necessary eyelid surgery falls under Part B, which covers outpatient medical services. The financial side of things is fairly predictable and follows a clear, two-step process.

First, you have to meet your annual Part B deductible. This is the amount you pay out-of-pocket each year before Medicare starts chipping in. Once that’s settled, Medicare’s coverage kicks in.

For any approved procedure, Medicare Part B generally covers 80% of the Medicare-approved amount for both the surgeon’s fee and the cost of the facility where it’s performed. This means you, the patient, are responsible for the remaining 20% coinsurance.

This 80/20 split is the foundation of how Original Medicare works. It’s crucial to confirm that your chosen surgeon accepts Medicare assignment, as the “approved amount” might be less than their standard rate. Sticking with a participating provider saves you from getting hit with unexpected excess charges.

How Medicare Advantage Plans Change The Game

Medicare Advantage plans, sometimes called Part C, are a whole different animal. They’re offered by private insurance companies that are approved by Medicare. While they are legally required to cover everything Original Medicare does, they get to set their own rules for how they do it.

This is where you’ll find the most variability. An Advantage plan might seem to offer lower out-of-pocket costs, but that often comes with a trade-off in the form of more restrictions.

- Network Limitations: Nearly all Advantage plans operate with a network of approved doctors and hospitals (like HMOs or PPOs). To get the best coverage, you absolutely must use a surgeon who is in-network. Step outside that network, and you could face a much larger bill—or find you have no coverage at all.

- Prior Authorization: This is a big one. Unlike Original Medicare, almost every Medicare Advantage plan will require prior authorization for a procedure like blepharoplasty. Your surgeon has to submit all your medical records, photos, and test results to the insurance company for approval before you can even schedule the surgery.

- Different Cost Structures: Forget the 20% coinsurance. Advantage plans typically use fixed copayments. For instance, you might pay a flat $300 copay for the surgery and another $250 copay for the facility fee. Depending on the total cost of the procedure, this could end up being more or less than the 20% you’d pay with Part B.

To make this clearer, let’s look at a simple comparison of what you might expect to pay with each type of plan.

Estimated Out-of-Pocket Costs for Covered Eyelid Surgery

| Cost Component | Original Medicare (Part B) | Sample Medicare Advantage Plan |

|---|---|---|

| Deductible | Annual Part B deductible applies first. | May have its own separate plan deductible. |

| Surgeon’s Fee | You pay 20% coinsurance after deductible. | Fixed copayment (e.g., $300). |

| Facility Fee | You pay 20% coinsurance after deductible. | Fixed copayment (e.g., $250). |

| Provider Choice | Freedom to see any doctor who accepts Medicare. | Must use an in-network surgeon for best coverage. |

| Pre-Approval | Rarely required for this procedure. | Prior authorization is almost always mandatory. |

As you can see, the financial responsibility can vary significantly. The absolute key is to understand the fine print of your specific plan.

Before you commit to anything, call your plan administrator. Confirm your benefits, ask about in-network surgeons, and get a clear estimate of your out-of-pocket costs for a medically necessary eyelid surgery. A little due diligence now can save you from major financial headaches later on.

Your Step-by-Step Journey to Getting Approved

Navigating the Medicare approval process for eyelid surgery can feel like a maze, but it’s a logical sequence. If you understand the steps ahead of time, you can build the strongest possible case from day one. It all starts with a simple, but critical, first conversation.

Your journey begins with your primary care physician. Lay out the issues you’re having with your vision and daily life, and they’ll provide a referral to an ophthalmologist or an oculoplastic surgeon. This referral is the first official flag in the ground, establishing that your concerns are medically significant enough for a specialist to investigate further.

The Specialist Consultation and Diagnostic Phase

The specialist’s office is where the real work of proving medical necessity happens. When you go for this consultation, be ready to explain exactly how your eyelids are impacting your life. Are you struggling to drive at night? Is reading becoming a chore? Does it interfere with your work?

Your surgeon will then perform the key diagnostic tests we’ve covered, especially the all-important visual field exam. This is the hard data that backs up your personal experience.

This appointment is also your chance to have a frank discussion about what you hope to achieve. A great surgeon will manage your expectations, explaining what’s possible both functionally and aesthetically. For those who demand the best, knowing how to find a board-certified plastic surgeon is invaluable. You need an expert who lives and breathes these nuances.

Once Medicare gives the green light, this is what the cost-sharing typically looks like.

After you’ve met your deductible for the year, Medicare steps in to cover 80% of the approved amount, leaving you with the remaining 20% coinsurance.

Securing Prior Authorization

If you’re on a Medicare Advantage plan, the next hurdle is prior authorization. Your surgeon’s team will package up all your documentation—the referral, their clinical notes, the high-quality photos, and your visual field test results—and send it off to your insurance company. From there, a medical review team will put your evidence under a microscope, comparing it against their coverage rules.

For most Advantage plans, this step is absolutely mandatory. If you move forward without getting this official approval, you can bet your claim will be denied, sticking you with the entire bill. Insurers are scrutinizing these claims more than ever, partly because the number of eyelid lifts billed to Medicare more than tripled between 2001 and 2011, with costs ballooning to $80 million annually.

What Happens After Submission and The Appeals Process

After your packet is submitted, you play the waiting game. If you’re approved, fantastic—you can schedule your surgery. But denials happen, and it’s crucial not to see a rejection as the end of the line. Medicare has a multi-level appeals process designed to give you several more chances to make your case.

A denial isn’t a final “no.” It’s just the start of the next phase. Your willingness to advocate for yourself is the most powerful tool you have in this process.

If your claim is denied, you have the right to appeal. The system is set up to be accessible and follows several distinct stages:

- Redetermination: This is the first step. You ask your Medicare Administrative Contractor—the company handling claims in your area—to take a second look. You can and should submit any additional evidence here.

- Reconsideration: If the redetermination fails, the case goes to a Qualified Independent Contractor (QIC). This is a completely separate entity that gives your file a fresh review.

- Administrative Law Judge (ALJ) Hearing: If you’re still denied and the amount in question meets a certain threshold, you can request a formal hearing before an ALJ.

- Medicare Appeals Council Review: This level involves a review of the judge’s decision.

- Federal Court Review: The final stop is a judicial review in a U.S. District Court.

While very few cases ever make it to federal court, a surprising number of initial denials are overturned at the first or second level of appeal, especially when the initial case was well-documented.

Common Questions About Eyelid Surgery Coverage

Even when you understand the core rules around medical necessity, the line between functional and cosmetic can feel blurry when it’s your vision on the line. You’re left with specific, real-world questions about your unique situation.

This is where we get into the details. We’ll tackle the nuances that cause the most confusion, from what happens when only one eye qualifies to how Medicare views lower eyelid issues. Think of this as the practical FAQ you need to navigate your own path to approval with confidence.

What If Only One Eye Meets the Medical Criteria?

This is an incredibly common scenario. It’s entirely possible for one eyelid to droop far more than the other, causing a measurable vision obstruction that meets Medicare’s strict criteria, while the other eye doesn’t quite make the cut.

In this case, Medicare acts with surgical precision. They will cover the blepharoplasty procedure for only the eye that demonstrably meets the functional impairment criteria.

If you have surgery on the other eye purely for symmetry or cosmetic balance, that’s on your dime. You will be responsible for 100% of the cost for the non-qualifying eye. It is absolutely vital to have a clear, detailed conversation with your surgeon’s billing office beforehand. They can provide an itemized quote that separates the covered costs from the non-covered, so there are no financial surprises.

Does Medicare Ever Cover Surgery on Lower Eyelids?

Getting coverage for lower eyelid surgery is far less common and significantly harder to secure. The reason is simple: most issues with the lower lids, like puffiness or “bags,” almost always fall squarely into the cosmetic category. They rarely interfere with your vision in a way that can be objectively measured.

However, there are a couple of very specific medical exceptions where surgery isn’t just cosmetic—it’s necessary. Medicare may provide coverage for:

- Ectropion: A condition where the lower eyelid turns outward, pulling away from the eye. This can cause chronic dry eye, constant tearing, and serious irritation.

- Entropion: The opposite problem, where the lower eyelid turns inward. This forces the eyelashes to constantly rub against and scratch the cornea, which is not only painful but can lead to corneal abrasions and infections.

For these conditions, the surgery is about protecting the health of your eye and alleviating chronic symptoms. As with any functional procedure, getting approval requires extensive documentation, including clinical notes and photographs, to prove the problem exists.

The key difference is the nature of the problem. Upper lid coverage is about restoring vision, while lower lid coverage is typically about protecting the surface of the eye from physical harm.

Can I Pay for the Cosmetic Part Myself?

Yes, you can, and it’s a common practice known as “split billing.” This is a great approach that lets you address both functional and aesthetic concerns in a single operation, which is often more convenient and cost-effective than scheduling two separate procedures.

Here’s how it works: Medicare agrees to cover the functional lift of your upper eyelids to clear your field of vision. During that same surgery, you might ask the surgeon to also remove a bit of extra fatty tissue or sculpt the eyelid for a more refined look. The functional part is billed to Medicare; the cosmetic portion is billed directly to you.

To do this by the book, you will be required to sign an Advance Beneficiary Notice of Noncoverage (ABN). This is a standard Medicare form confirming that you understand certain parts of the procedure are not medically necessary and that you agree to be financially responsible for them. The ABN protects you from surprise bills and ensures everyone is on the same page.

How Does a Medigap Plan Affect My Out-of-Pocket Costs?

A Medigap plan, or Medicare Supplement plan, can be a huge financial asset for a medically approved eyelid surgery. These plans are designed to work alongside Original Medicare to pick up your share of the costs.

After Medicare Part B pays its 80% of the approved amount for your surgery, the remaining 20% coinsurance is sent to your Medigap plan. Depending on the plan you have (like a Plan G, for instance), it will pay some or all of that remaining balance.

With a good Medigap plan, your out-of-pocket cost for the surgery itself could be minimal or even zero, once you’ve met your annual Part B deductible. It’s a powerful way to make necessary medical care more affordable. But remember the golden rule: Medigap only pays for services that Original Medicare first approves. It will not provide a dime of coverage for a surgery that Medicare deems purely cosmetic.

Finding the right surgeon is the most critical decision in this entire process. A top-tier specialist not only delivers exceptional results but also has the expertise to navigate Medicare’s complex documentation requirements. For discerning patients seeking elite surgical specialists, Haute MD provides a curated network of the nation’s most respected and rigorously vetted physicians. Connect with a trusted, board-certified expert who understands how to build a successful case for the care you need. Discover premier providers at Haute Living’s Haute MD.